What is AI Chief Accountant Assistant

1. Concept

The AI Chief Accountant Assistant app controls completion of Accounting-department tasks and is aimed at chief accountants and managers responsible for those tasks. It is especially helpful during time-critical operations such as month-end close, year-end close, or audit preparation.

Key features

-

Define any number of control scenarios for different situations.

-

Run an evaluation at any moment – on the whole scenario, a selected section, or a single task.

-

Write task conditions in natural language.

-

AI support delivers a level of flexibility previously impossible.

-

Full oversight of evaluation results – the system not only checks each condition but also explains its decision and lets you inspect the underlying data.

2. Prerequisites

a) Installation

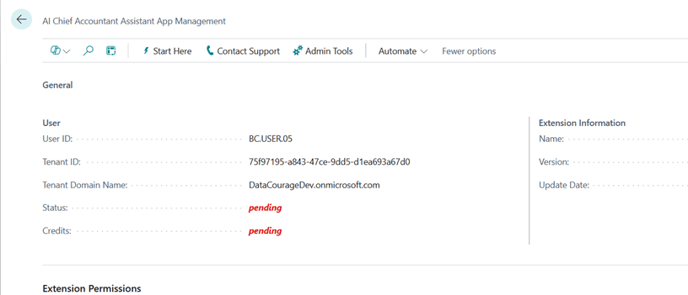

b) Activation

-

Open the app management from the main ribbon on the Chart of Accounts page.

-

In the App Management page that appears, choose Start Here.

-

After clicking Start Here, a Partner information window will appear, where you need to provide your company’s Partner name and contact Partner email address. After confirming, you will receive a message about the activation of your license.

-

If you have already provided this information, you will receive a popup – click Yes to activate your license.

-

-

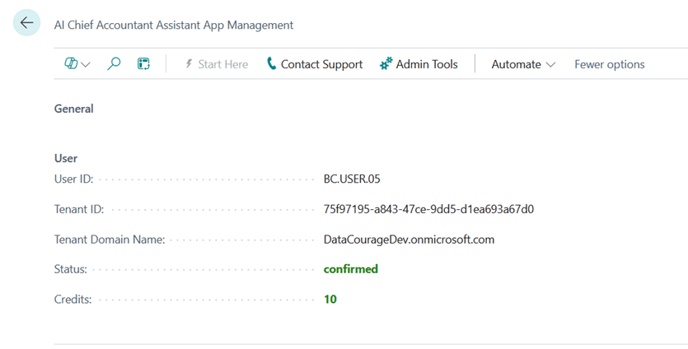

Following this action, the application status will change to confirmed.

c) User Setup

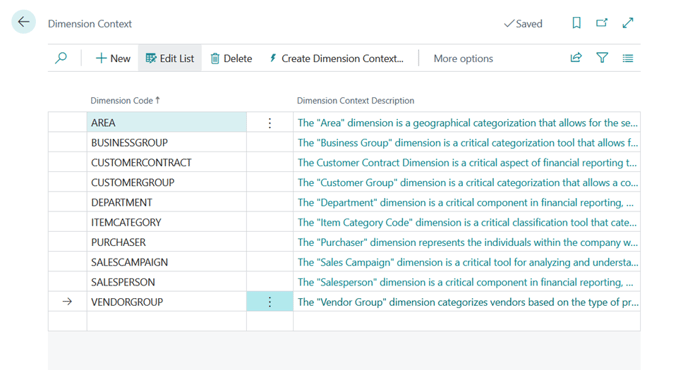

d. Dimension Context

-

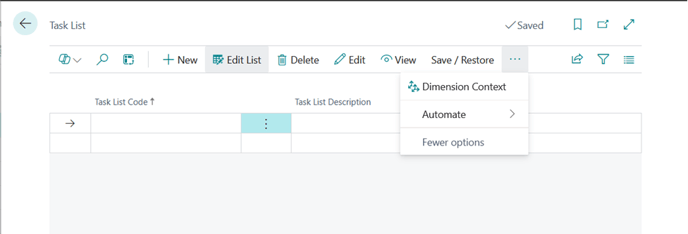

Open from the main ribbon on the Chart of Accounts page.

-

In the Task List page that appears, choose the three-dots menu and select Dimension Context.

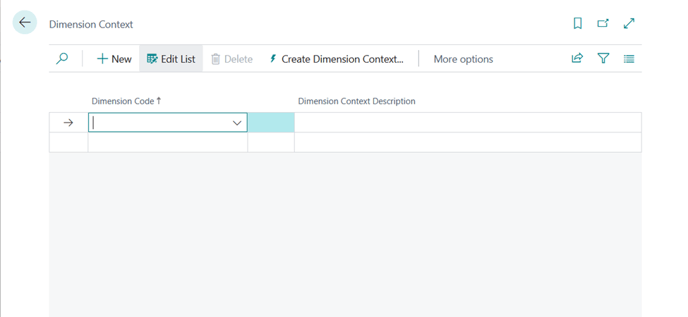

-

In the Dimension Context page, choose Create Dimension Context.

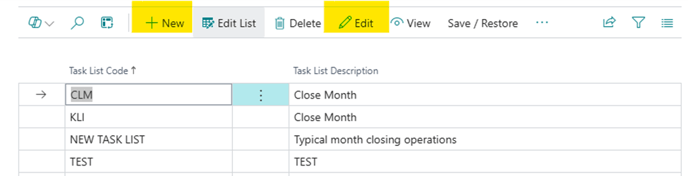

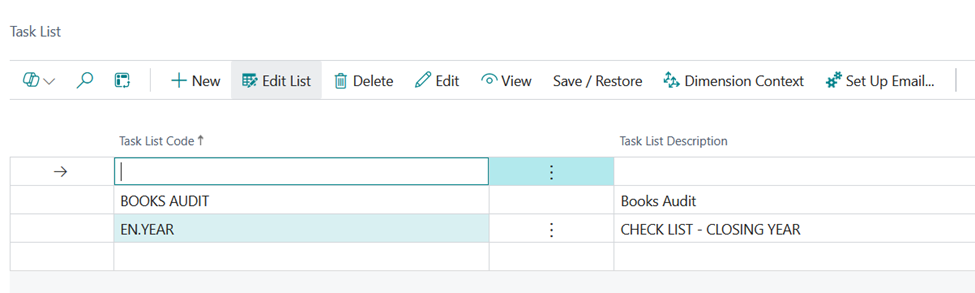

3. Creating a Task List

-

Open the app from the main ribbon on the Chart of Accounts page.

-

In the Task Lists page that appears, choose + New on the ribbon.

-

Enter a Task List Code and Task List Description.

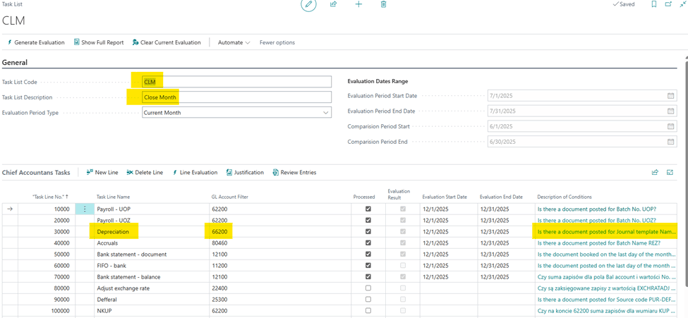

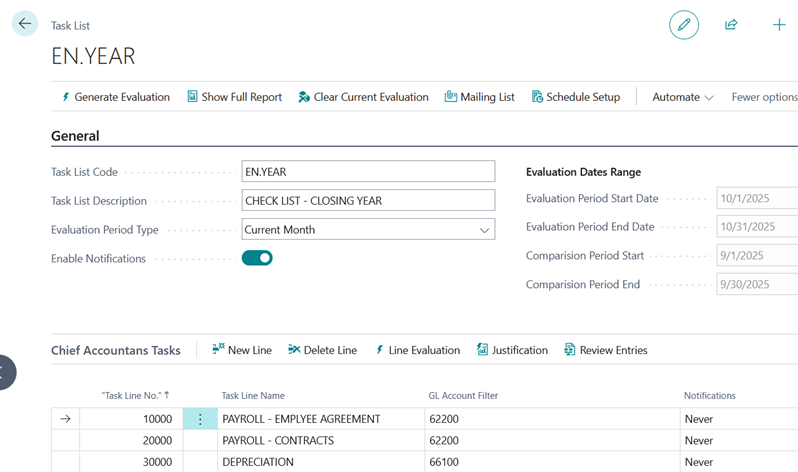

4. Defining Tasks

-

In the Task List, scroll to the Chief Accountant Task section and choose New Line.

-

Enter the Task Name (the Task Line No. fills in automatically).

-

Set the G/L Account Filter; use the lookup to select accounts. The filter must include at least one account of type Posting.

-

Select Description of Conditions to open the editor.

-

Write the condition text and choose OK.

-

Add further task lines as needed or proceed to evaluation.

5. How to Write Conditions

To ensure reliable results, follow these guidelines:-

Phrase each condition so it can be answered Yes/No.

-

Conditions must relate to entries in the General Ledger Entry table.

-

Reference any field(s) or posted amounts in those entries.

-

You may query values stored as dimensions.

-

Compare document count, entry count, or summed amounts with another period (typically the previous month).

-

Avoid strict equality (“must equal …”). Instead, use “approximately”, “roughly”, or specify an allowed tolerance (%) or amount.

-

Limit the account range as much as possible — fewer records mean faster, more reliable evaluation.

-

Avoid very complex conditions that blend multiple topics; you can analyze the same account several times under separate tasks.

-

Refer to specific field names from G/L Entry whenever possible.

-

Be precise: state whether you are checking an amount, number of unique documents, number of entries, unique values in a field, etc.

-

For text fields you can use similar to, containing, starts with, etc.; exact matches are not required.

-

Avoid basing checks purely on the Description field — this can generate very large datasets that strain the AI.

-

Write conditions as if explaining them to a new employee; they should be clear and actionable.

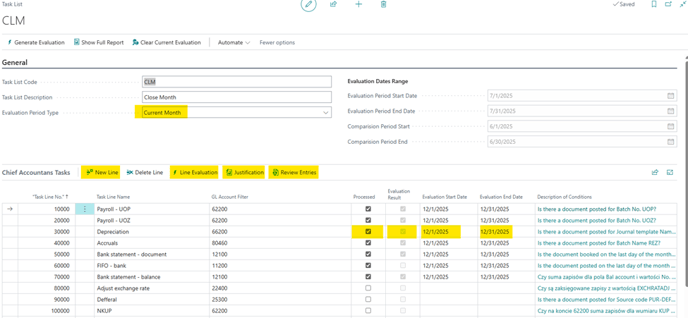

6. Performing Task Evaluation

You can evaluate tasks line-by-line, for selected lines, or for the entire list.

-

Open Task Lists, select the list, and choose Edit (use View for read-only access).

-

Only lines with Processed = No can be evaluated.

-

To reset a line, set Processed = No manually or choose Clear Current Evaluation on the ribbon.

-

Set the Evaluation Period Type (Current Month, Previous Month, or Custom). The dates appear in Evaluation Dates Range; for Custom you can edit them directly.

-

To evaluate a single line: select it and choose Line Evaluation. When finished, the system fills Evaluation Start Date, Evaluation End Date, Evaluation Result, and marks the line Processed = Yes.

-

View details with Justification (AI explanation) and Review Entries (source data).

-

To evaluate all unprocessed lines at once, choose Generate Evaluation. A progress window lets you cancel without losing completed results.

7. Additional Functions

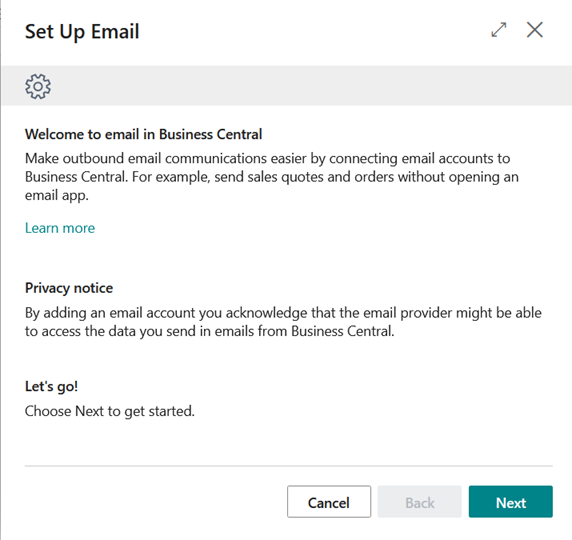

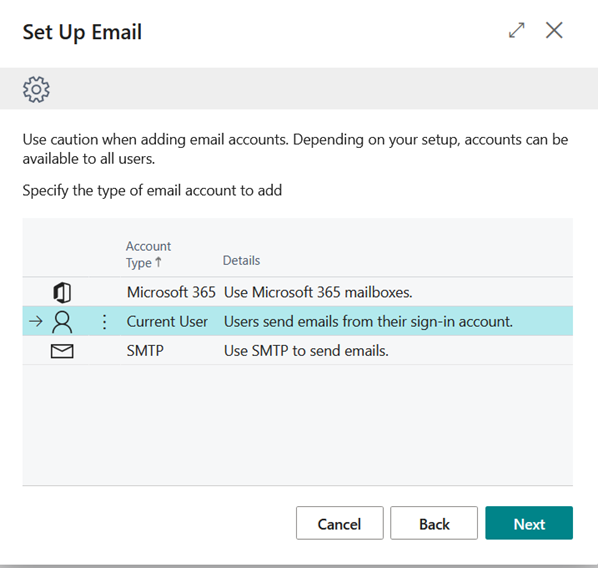

You can get email notifications for your task lists.

Setup:

- Open application and click on “Set Up Email” to configure your BC email connection

- Open the task from which you want to receive notification.

- In the task list, toggle “Enable Notification”

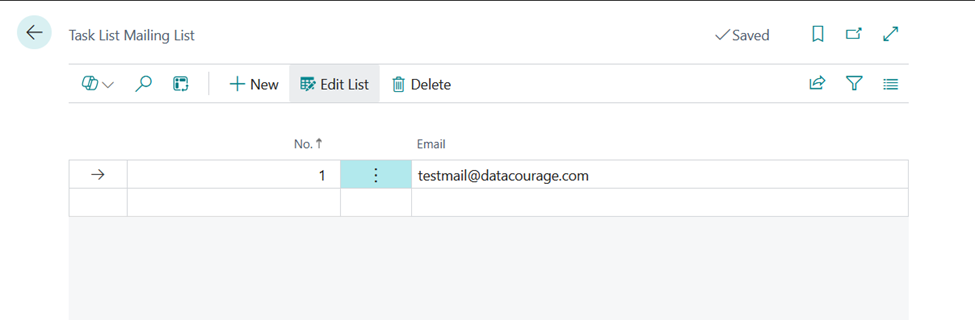

- To set the email address to which notifications will be sent, open the “Mailing List” from the task bar

- Enter email addresses into table

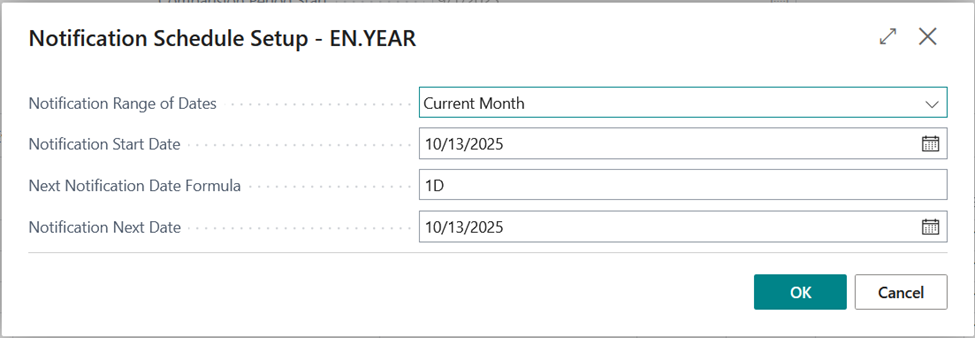

- To set the email address to which notifications will be sent, open the “Schedule Setup” from the task bar

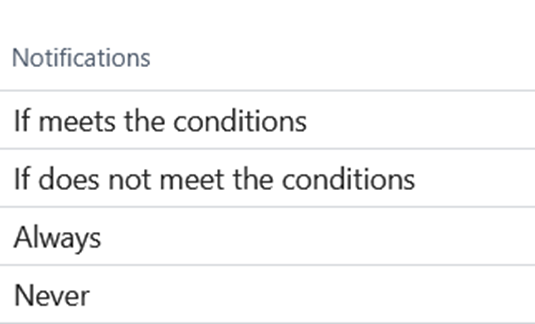

- In the Chief Accountant Tasks table, in the Notifications column, select the condition for which notifications should be sent for individual tasks.

8. Additional Functions

-

Evaluation Report – export the current results to Excel with Show Full Report.

-

Import/Export Task List – export a task list to a text file and import it into another (or the same) company; you’ll be prompted for a new Task List Code when necessary. Accessible from the Task Lists ribbon.